6 minsMay 20, 2018

When you apply for a home loan balance transfer, the new lender/bank treats it like a new home loan application, but with a slightly different approach.

This is because, a home loan balance transfer to another bank is form of refinancing your existing home loan – also called as ‘home loan take over’.

The objective of home loan balance transfer is to save on the interest cost by moving the loan balance to a lender/bank offering a lower rate of interest on home loans.

When interest rates in the economy fall, not all lenders reduce interest rates in equal scale for a variety of reasons –– and that’s when home loan balance transfer is an attractive option, particularly when you are dissatisfied

with the service.

However, while doing so, pay attention to the processing fee (which is usually upto 1% of the loan amount) payable to new lender/bank. At times to acquire business, a lender/bank may reduce or waive off the processing fee if your credit score

(which reflects your credit history and credit worthiness) is respectable or if they have a special campaign for a specific time period.

Note that, the overall benefit of transferring a home loan has to outweigh the cost. It should ideally reduce your Equated Monthly Instalment (EMI) burden and

aid you repay your home loan sooner. This has positive bearing on your credit score, and hence, negotiating the terms of home loan balance transfer is critical.

Another benefit is that you can adjust the tenure of your loan, at the bank you are transferring your loan to, provided you are eligible within the age limit. With this you can adjust your EMI burden.

You can also avail a top-up on transferring your loan, which can be used for your personal needs

Use Axis Bank’s home loan balance transfer calculator to understand

how much you could save on transferring your home loan to Axis Bank.

At Axis Bank, the process is hassle-free. Axis Bank follows an income-based home loan transfer. The eligibility is based on the seasoning and track-record of existing loan only.

Who can apply?

- Salaried individuals (working in government and private sector)

- Professionals (i.e., doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, management consultants, etc.)

- Self-employed in business and filing Income-Tax Returns

- Individuals over 21 years of age and ideally not over 60-65 years.

Axis Bank’s premium banking customers can reach out to their relationship managers for details of special benefits.

The documents required for a home loan balance transfer are:

The above documents need to be accompanied with the application form duly filled to new lender/bank.

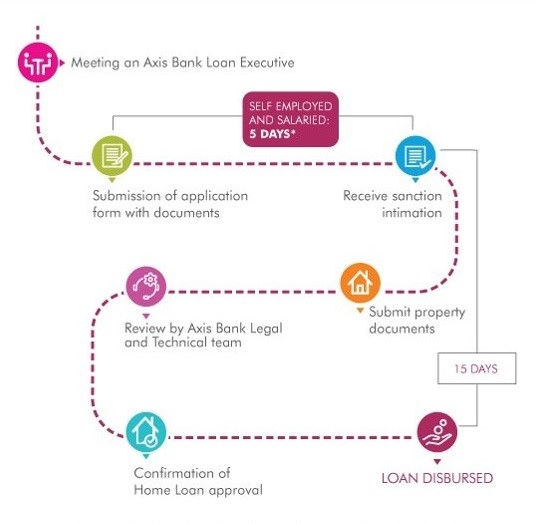

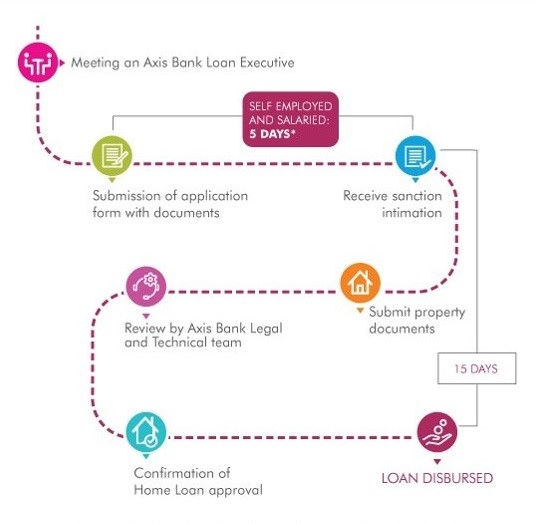

The process followed at Axis Bank is straight forward involving due diligence.

(Image source: www.axisbank.com)

Once the entire back-end process is completed and home loan balance transfer is approved by the new lender/bank, it will transfer (i.e. disburse) the outstanding loan amount to the previous lender/bank and the home loan account will be closed.

All pending ECS and post-dated cheques with the earlier lender/bank will stand cancelled. You will be required to provide a new ECS mandate and issue security cheques to the new lender/bank.

The future EMIs on the outstanding loan balance will be payable to the new lender/bank as per the new terms and conditions.

When you are transferring your home loan balance transfer, keep in mind the following:

Don’t get tempted to teaser rates –

At times banks to lure you may offer lower fixed home loan rates for a short period of time –––initial couple of years–––– but after that readjust/raise

rates to floating interest (as per market). You should steer away from such home loan teaser schemes, because when rates are increased, it potentially outdoes the benefit of lower rate enjoyed for a couple of years, making it worthless.

Weigh the cost-to-benefit –

As you may know, in addition to interest there are various cost affixed to a home loan viz. processing fee, stamp duty, legal charges, valuation fee, and other transfer related technical charges.

Hence, when you mull over transferring your home loan balance, make sure the benefits outweighs the costs.

Read the fine print –

In the addition to what appears to the naked eye, the finer details are mentioned in the terms and conditions. Thus, ensure that you read them carefully to discover any hidden cost, loan-to-value ratio,

prepayment penalty, etc.

Opt for a new lender/bank that can offer best experience –

Speak to home loan customers of the new/lender and learn from their experiences as regards service. This will avoid unpleasant experiences later. Opt for a home loan

transfer with a lender who offers the best service.

Home Loan Balance Transfer vs. Resetting: What to choose when

By now, you may have realised that the lender/bank follows an extensive procedure for a home loan balance transfer. Breaking relationships with your existing lender/bank may not make sense, particularly when the benefit is only marginal.

Likewise, when you already paid a major chunk of your home loan, the refinancing option may prove to be imprudent; because by then the value of the collateral, i.e. the house would be greater than outstanding loan due.

Instead, what you could do is, approach your existing lender/bank to reset or renegotiate the terms for the remaining balance, which is a far simpler process. By then, you’ve established a rapport with the bank, perhaps know their staff

who could help you in resetting your existing home loan. In case the bank declines and if you are losing a good amount of benefit, then you may consider transferring the home loan balance to a new bank/lender.

To conclude…

The transfer of home loan balance or refinancing is beneficial because it reduces EMIs, saves on total interest outgo, shorten you home loan tenure, potentially increase your credit score, get better service, and so on.

Just make sure the pros outweigh the cons before taking a decision. Accounting for factors such as interest rate, outstanding home loan amount, residual home loan tenure, transfer cost and service, is essential while considering a home loan amount balance transfer.

Happy Banking!

Disclaimer: This article has been authored by PersonalFN, a Mumbai based Financial Planning and Mutual Fund research firm known for offering unbiased and honest opinion on investing. Axis bank doesn't influence any views of the author in any way. Axis Bank & PersonalFN shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision.