7 MinsJuly 26, 2021

Two farmers planted crops in their fields. One planted wheat, while the other planted wheat in half of the area and corn in the other half. That year wheat crops were destroyed due to pests. The farmer who had planted only wheat lost his entire

crop and all his earnings were wiped out. The other farmer also lost money on his wheat crops but earned money from the corn. He was able to survive the bad season, thanks to crop diversification.

The same principle applies to investments too. You must not put all your money in one kind of asset class or investment avenue. You must select your investment avenues based on parameters such as your income, age, the nature of your goal, the

time required for it and so on which will help define your risk profile.

Let us understand the importance of diversification and asset allocation and how we can follow them.

Diversification

The primary objective of diversification is to build an efficient investment portfolio, which will help even out risks in the different kinds of asset classes. For instance, if your equity assets see a decline due to a market downturn, your fixed-income

assets may continue to offer stable returns. Or, if there is an unexpected fall in interest rates leading to lower returns on your bank fixed deposits, your stocks may earn high returns if the market does well.

At the same time, the portfolio should also help you achieve your envisioned financial goals. Thus, when you diversify, consider your age, risk profile, financial situation, broader investment objectives, the financial goals you are addressing,

and the time in hand, rather than choosing investment avenues in an ad hoc manner.

However, one must guard against over and/or under-diversification. Just as under-diversification increases the risk and is unhealthy, over-diversification is not good either. Beyond a point, over-diversification offers no extra benefit, doesn’t

help lower the risk, and on the contrary, makes the investments portfolio bulky and tough to manage. Hence, make sure you do not end up overcrowding your investment portfolio.

When building your investment portfolio, you must ensure that it is:

- Diversified across asset classes (Equity, Debt, Gold, and Real Estate) the smart way.

- Diversified across investment avenues within each asset class (Stocks, Different types of Mutual Funds, Bank Fixed Deposits, Bonds, Debentures, Sovereign Gold Bonds,

Gold ETFs, Real Estate, etc.)

- Diversified across issuers of securities rather than betting on few names, which potentially results in concentration risk.

- Diversified across investment time horizon, whereby you assess your liquidity needs and hold investment portfolios addressing your short-term, medium-term, and long-term financial goals.

- Diversified across countries or regions to gain from economic scenario/s in those countries or regions.

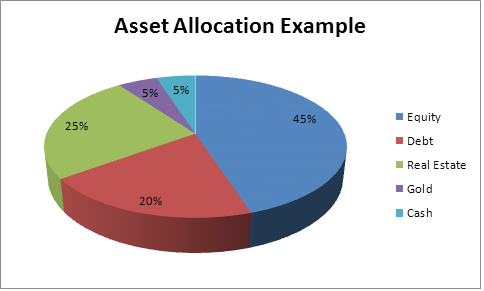

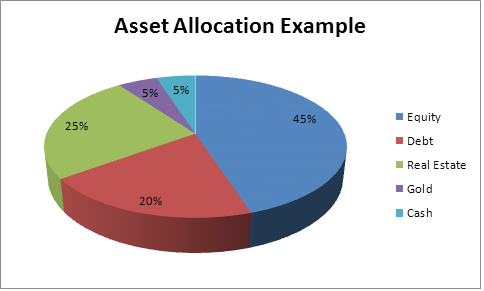

Asset Allocation

The other mainstay or cornerstone of the portfolio building exercise is asset allocation. It refers to distributing your investible surplus across asset classes such as equity, debt, gold, real estate, or even holding cash.

Distribution of

investible surplus across asset classes

The graph above is for

illustrative purposes only.

(Source: PersonalFN)

Every asset class has a different risk-return profile. Typically, if the risk is higher, the potential return is also higher. You should clearly define the asset allocation and strictly follow it, considering various factors like your age, risk

appetite, broad investment objective, financial goals, and time in hand before goals befall. As long as your asset allocation is in place, and you select the right investment avenues, you need not worry when the economy sees turbulence or

markets become volatile. Plus, it can help address your liquidity needs.

[Also Read: How to Become a Wise Investor]

The key factors that define your asset allocation are:

Your age – Usually, the ability to bear risk diminishes as the age increases. Hence, when you are young you may have more equity in your portfolio as your risk appetite might be higher. Ultimately, when you are nearing retirement,

capital preservation should be the primary objective. Although other factors need to considered along with age to decide on the ideal asset allocation.

Your income – If you are a salaried employee with a fixed monthly income, you may afford to allocate a high portion to risky assets like equity and some in safe instruments depending on your age. But if you are self-employed

and your income varies every month, you may not always be willing to take the risk. You may instead prefer safer avenues such as bank fixed deposits, debt mutual funds, Small

Saving Schemes (SSS), etc.

So, the amount you invest is also a function of the income you earn. You must allocate your assets keeping in mind your current and future income growth potential.

Your expenses – Cutting down on unnecessary expenses and living within your means by engaging in budgeting is in the interest of your financial health and wellbeing. This will enable you to save meaningfully every month,

every year, and deploy the investible surplus in various investment avenues to accomplish your financial goals.

Time to goal – If you have many years for your goal, you may be able to assume higher risk. Hence, you may allocate a larger portion in high-risk assets such as equity.

Say you have 25 years to save for your child’s wedding. Since it is a long way off, you may consider investing a major portion of the portfolio directly in stocks or equity mutual funds.

However, if the same goal is just 3-5 years away, the focus should be on saving or protecting wealth with safe avenues.

An asset allocation plan with a review (once in six months) and rebalancing, if required, offers the following benefits:

1) Diversifies the portfolio, which is one of the basic tenets of investing

2) Reduces dependence on a single asset class and hence, may lower the investment risk

3) Serves as a safeguard in case of a market downturn

4) Provides freedom from timing the market

5) Ensures adequate liquidity of the portfolio

6) Earns efficient inflation-adjusted returns

7) Helps achieve the envisioned financial goals

Remember, diversification and asset allocation are the two main pillars for your investment portfolio, and they are the essence of successful investing.

Disclaimer: This article is for information purpose only. The views expressed in this article are personal and do not necessarily constitute the views of Axis Bank Ltd. and its employees. Axis Bank Ltd. and/or the author shall not be responsible for any direct / indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information. Please consult your financial advisor before making any financial decision

Mutual Fund investments are subject to market risk, read all scheme related documents carefully. Axis Bank Ltd is acting as an AMFI registered MF Distributor (ARN code: ARN-0019). Purchase of Mutual Funds by Axis Bank’s customer is purely voluntary and not linked to availment of any other facility from the Bank. *T&C apply